Need a Payroll Health Check?

Start with Our Payroll Compliance Review.

From just $800+GST, our Payroll Compliance Review offers a proactive, low-cost way to assess your payroll governance, reduce compliance risk, and determine if your systems are real-time payroll audit ready – especially with new wage theft legislation coming into effect.

Here’s what’s included:

- Half-Day Review: On-site or virtual session with your payroll, HR, and finance team.

- Software Scan: Evaluation of your current payroll and time-tracking platforms.

- Compliance Report: Tailored report aligned to our Five Pillars of Payroll Compliance.

- Actionable Insights: : Clear, non-binding recommendations to strengthen your compliance.

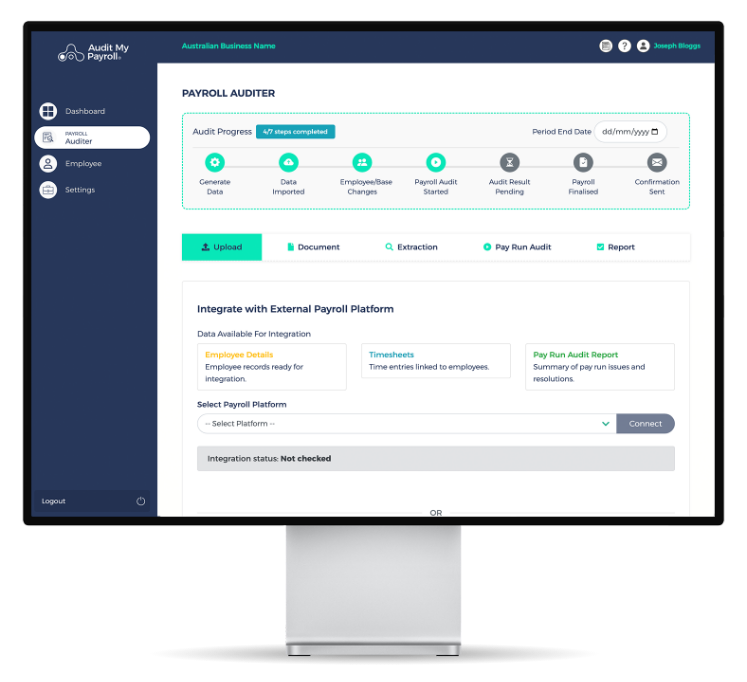

Watch how we simplify payroll compliance.

Historical Payroll Errors. Real Financial Consequences.

A Historical Payroll Audit Can Clear the Air.

Many businesses unknowingly overpay or underpay staff. Our Historical Payroll Audit pinpoints discrepancies quickly, giving you clarity, control, and confidence in your payroll – past and present – setting you up for the future.

- Powered by AI for faster, more accurate results

- Pinpoints underpayments with precision

- Now up to 75% more cost effective

Future-Proof Your Payroll – A Historical Audit doesn’t just fix the past; it’s your gateway to better payroll management.

Closing the Loopholes

With wage theft now a criminal offence, businesses must take payroll compliance seriously and these areas can be tricky for small business to stay on top of …

- Increase accountability for wage compliance.

- Strengthen worker protections and prevent underpayments.

- Provide clearer guidelines on employment classifications.

- Ensure fairness between large and small businesses in compliance expectations.

Closing the Loopholes

- Increase accountability for wage compliance.

- Strengthen worker protections and prevent underpayments.

- Provide clearer guidelines on employment classifications.

- Ensure fairness between large and small businesses in compliance expectations.

Underpayment risk factors

Various factors drive higher risks of underpayments in certain industries, and although correct classification of employees (to the relevant award and grade) is a key risk factor across all industries, these are the most common risk factors to employee underpayments:

Employee Classification

Employers need to interpret awards and determine how to classify their employees to align to relevant awards; misclassification (e.g. the wrong award, or wrong grade in an award) can lead to underpayments.

Shift Work

Jobs which require workers to work overtime or unusual work schedules (e.g. night shift) often have complex penalty and loading rates which need to be accounted for.

Casual & Low Skillsets

Unsecure work which involves low skill levels often leads to workers being deemed ‘replaceable’ and thus at risk if underpayment concerns are raised.

Temporary Migrant Workers

Recent migrants to Australia are 40% more likely to be underpaid relative to long-term residents. Many are less educated on labour laws and may fear reporting underpayments due to being sponsored by their employer to work in Australia.

All businesses deserve reliable, straightforward solutions to payroll compliance challenges regardless of the industry. The risk of non-compliance is present in every industry and Audit My Payroll can deliver peace of mind through education and clear, robust solutions.

Real payroll

compliance support,

whatever your industry:

You deserve reliable, straightforward solutions to payroll compliance challenges. We’re here to do just that, saving you time and delivering peace of mind along the way.

Don’t see your industry? We support businesses across all sectors. Contact us to learn how we can help yours…

Life in the hospitality industry moves fast, and payroll needs to keep up. From juggling casual rosters and high staff turnover, our solutions simplify compliance, so you can focus on what you do best: delivering exceptional guest experiences.

Our processes are designed to navigate and simplify intricate awards like the Hospitality Industry (General) Award 2020, giving you the confidence to manage payroll compliance effortlessly.

From shearing sheds to seasonal harvests, agriculture payroll compliance is as diverse as the industry itself. Whether you’re managing the Horticulture Award 2020, EBAs, or unique contract arrangements, we’re here to simplify the process and give you more time to focus on your operation whether that’s crops, livestock, or beyond.

Managing payroll in healthcare means dealing with shift work, overnight penalty rates, and ever-changing awards. Whether you’re navigating the Health Professionals and Support Services Award 2020 or the Nurses Award 2020, we understand the pressure you’re under to get it right. Our solutions make compliance one less thing to worry about, so you can focus on patient care.

Payroll compliance in construction isn’t just about pay rates. It’s about managing allowances, multiple sites, and contractor agreements. Whether you’re working with the Building and Construction General On-site Award 2020 or custom EBAs, we take the stress out of compliance so you can focus on meeting deadlines and budgets.

From weekend penalty rates to casual employee rosters, retail payroll compliance can quickly become a juggling act. The General Retail Industry Award 2020 and EBAs often add complexity, but we’re here to help lighten the load so you can keep the shelves stocked and customers happy.